- High-grade silver discovery takes shape at Selena

- Ridgeline (RDG-V) has $3.5M in treasury to drill Nevada projects

- Nevada Gold Mines is hitting boomers near Ridgeline ground

By James Kwantes

Resource Opportunities

Nevada’s silver-laden history branded it “The Silver State” but the present is paved with gold. The more valuable precious metal is Nevada’s top export, worth US$2.7 billion in 2019 (casino games is a distant second at $550 million).

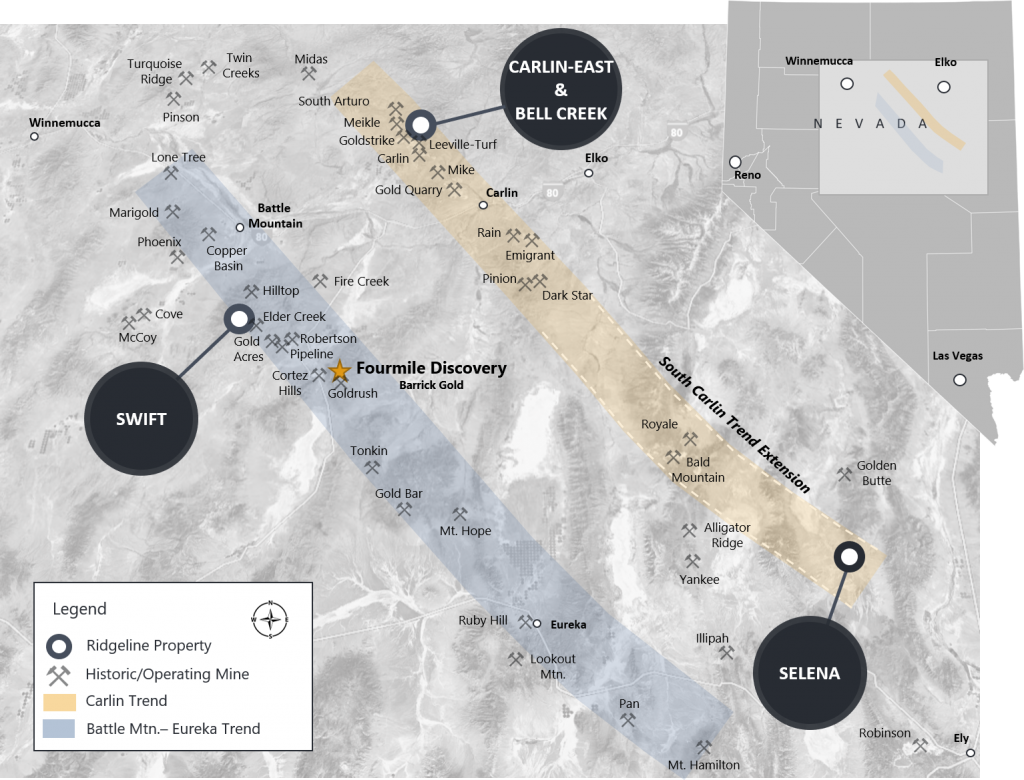

Since the 1962 discovery of Carlin-type gold by John Livermore and Alan Coope, more gold has been discovered in Nevada than almost anywhere on Earth. Gold ore is blasted and trucked out of giant open-pit deposits like the Goldstrike pit in the Carlin trend. It’s dug out from high-grade operations deep underground in the Carlin and Battle Mountain-Eureka trends and the Cortez camp. Gold also bleeds out of dozens of oxide heap-leach projects that dot the state.

Nevada’s importance came into sharp focus two years ago when Barrick and Newmont — the world’s two largest gold miners — combined their operations in the state to form Nevada Gold Mines (NGM). That deal was struck only after Barrick CEO Mark Bristow launched a hostile bid for Newmont, backing off when Newmont agreed to form the Nevada joint venture. Barrick is the operator and owns 61.5% of Nevada Gold Mines, which produced 2.13 million ounces of gold in 2020. It’s an important profit center for both companies.

FROM PRAIRIES TO PREMIER

Gold is also what brought geologist Chad Peters from Manitoba to Nevada, where he lives with his wife Carla and their two young sons. Peters is president and CEO of Ridgeline Minerals (RDG-V, RDGMF-OTC), which IPOed last year and drilled two of its four exploration projects in Nevada’s most important gold districts. If junior miners are lottery tickets, Ridgeline is more like a handful of them — each project could be worth multiples of the company’s current enterprise value of $13.8 million.

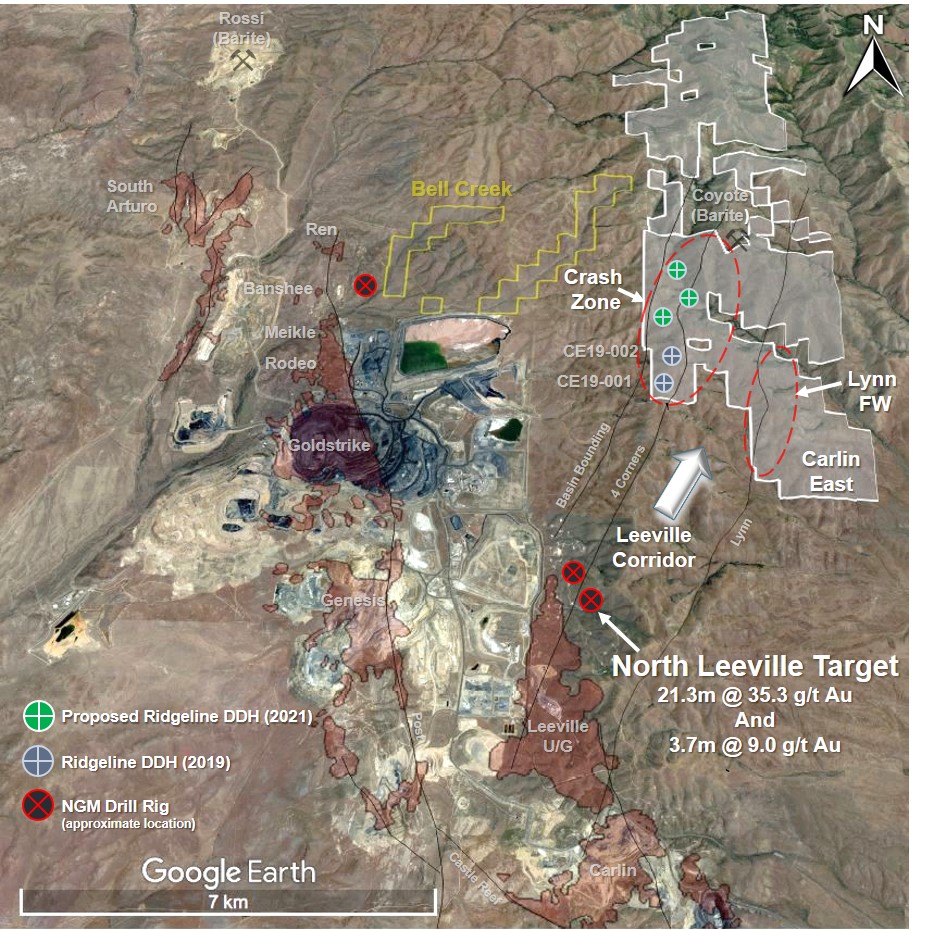

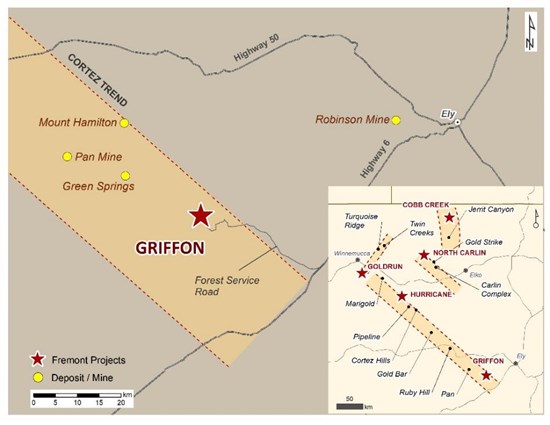

Ridgeline is planning follow-up drill programs in 2021, with a focus on expanding their high-grade oxide-silver-gold discovery at Selena in the South Carlin trend, and Swift in the Cortez district. The goal at the latter is to identify a high-grade multi-million-ounce gold deposit. But Ridgeline’s most valuable projects could still end up being the two that are under the radar for now: Carlin-East and Bell Creek. Those properties are in the heart of the Carlin trend, near Goldstrike, and Nevada Gold Mines has been hitting world-class intercepts on the doorstep. More on those later.

Ewan Downie’s Premier Gold (PG-T) plays a primary role in the story of how Peters ended up in Nevada. While studying geology at the University of Manitoba, Peters landed a summer job with Premier Gold working in Ontario’s Red Lake gold camp. That gig turned into a 10-year career with the company, much of it in Nevada. Premier Gold made its first foray into the state in 2012 with the purchase of the mothballed Cove mine project in the Battle Mountain-Eureka trend. Peters and his wife Carla moved down to Winnemucca, Nevada the same year.

At 27, Peters was the senior exploration geologist in charge at McCoy-Cove, where he led the discovery of the CSD Gap deposit. Cove now hosts 1.7 million ounces of gold at 10.8 g/t and is one of Nevada’s highest-grade undeveloped gold deposits. It’s also one of the cornerstone assets of i-80 Gold Corp., the Nevada-focused spinout that will emerge from the friendly acquisition of Premier Gold by Equinox Gold (EQX-T), announced December 16. The CSD Gap discovery was based on a new geological interpretation, an MO that Peters is now employing with Ridgeline.

Peters rounded out his time with Premier as the Nevada exploration manager, overseeing all of the exploration projects as well as Premier’s JVs with majors — including the South Arturo mine with Barrick. As the company advanced its portfolio in Ontario, Nevada and Mexico, Premier’s focus shifted from exploration to development and production. Exploration is Peters’s passion and he decided to strike out on his own in 2018, co-founding private exploreco Ridgeline Minerals with good friend Steve Nielsen, who also happened to own a drilling company. That wasn’t a coincidence …

BOOTSTRAPPING IN A BEAR MARKET

“It was the best of times, it was the worst of times.” The Charles Dickens quote from A Tale of Two Cities could also apply to Ridgeline’s early days. Peters left a well-paying job with a solid employer and took the plunge, starting Ridgeline out of an “office” in the garage of his Winnemucca home. Local relationships that he built living in Nevada helped Peters secure the company’s land package through EMX Royalty Corp. (EMX-V) — now one of the largest held by a junior in the state with three of the four projects literally at Nevada Gold Mines’ doorstep.

Next, Peters partnered with Neilsen, a Nevada businessman who owns Envirotech Drilling and had worked with Chad at the Cove discovery. The two struck an equity deal that gives Ridgeline the cheapest drilling costs of any company in Nevada. That means more dollars into the ground, increasing the odds of new discoveries. This partnership is already paying dividends with a shallow-oxide silver discovery announced at Selena months after the IPO.

The launch forced a new skill set on a guy more accustomed to navigating rock types than capital markets: raising money for a private exploreco during the depths of a bear market. It was a rather gruelling experience that tested his mettle and made for some interesting dinnertime conversations, Peters recalls: “I told Carla it would take me three to six months to get the company financed, and she ended up supporting the family for 14 months.” Private financing rounds at 12 and 22 cents with Ridgeline’s core shareholders funded early exploration, with the Peters family putting in $150,000 of their savings.

at Nevada Gold Mines’ Sinkhole Breccia target.

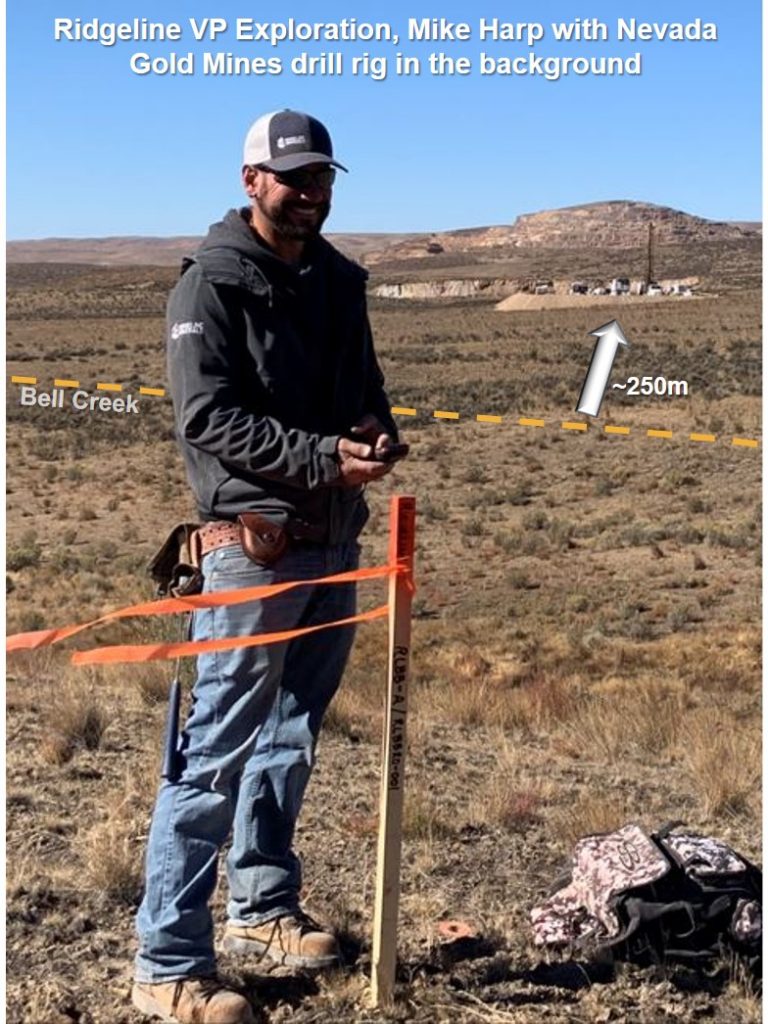

Peters tapped Mike Harp, an exploration geologist with 8 years of experience with Gold Standard Ventures (GSV-T) in the Carlin trend, as Ridgeline’s VP Exploration. Harp was a senior member of the team that found 5 million ounces for Gold Standard in the Railroad-Pinion district, including leading discovery of the North Dark Star deposit. Duane Lo, a veteran of the mining exploration sector, came on early as CFO and splits his time between Ridgeline and Entree Resources (ETG-T). At the board level, Peters brought in Newmont’s longtime Nevada specialist Lewis Teal, who has decades of discoveries under his belt and has authored multiple publications on the Carlin trend.

Relationships are one of the keys to Peters’s success and it shows in Ridgeline’s share registry. Early shareholders include heavyweights of the junior mining scene such as David Elliott, Paul Stephens and Andre Gaumond. Peters remains on good terms with Premier boss Ewan Downie, who invested in Ridgeline while the company was still private. He has shareholders on both sides of the recent Premier-Equinox deal — the Equinox management team also put money into Ridgeline’s IPO and Equinox CFO Peter Hardie joined Ridgeline’s board in October 2020. “The Davids” from EMX — CEO David Cole and chief geologist David Johnson — both invested in Ridgeline personally before it was publicly listed.

Three years after that bumpy launch, Ridgeline sports a $17.3-million market capitalization, with $3.5 million in the treasury to drill four high-potential projects in Nevada’s most important gold districts. As it turned out, the early adversity Peters faced running a private exploreco was good preparation for going public.

The Ridgeline chart has been a roller-coaster since the August 2020 IPO at 45 cents that raised $5 million. The stock promptly ran up to 75 cents before a long slow slide — some investors bailed when there were no immediate discoveries — took shares down to lows of 30 cents in December. “Discoveries aren’t made overnight,” Peters remarks. “At Selena it took us three phases of drilling and 21 holes to make a discovery.”

“Discoveries aren’t made overnight. At Selena it took us three phases of drilling and 21 holes to make a discovery.”

Chad Peters, Ridgeline Minerals CEO

In this emerging gold bull market, Nevada is again a hotbed of gold and silver exploration, with hundreds of juniors searching for economic deposits across the state. Many of those projects are far removed from the main Carlin/Cortez/Battle Mountain-Eureka trends, a gold epicenter that hosts a combined 220 million ounces of past production and current resources. Ridgeline is well-positioned with 125 square kilometres of ground in the middle of all three districts.

ONE IS NOT LIKE THE OTHERS

Having a Canadian CEO who lives in Nevada sets Ridgeline apart in a state crowded with junior miners whose bosses live elsewhere. His northern roots also landed Peters, now 34, an unexpected side gig — he was recruited to coach his son’s hockey team after other parents discovered he was Canadian.

Those “boots on the ground” put Peters at the center of the action, allowing him to hear of new discoveries first or soak up important tidbits of intel. It has even opened doors to acquiring cheap but valuable data, or claims from the prospectors who still control large land positions on Nevada’s still-fractured claims map. Peters lives less than a two-hour drive from Ridgeline’s Swift, Carlin-East and Bell Creek projects and five hours from Selena.

It’s not Ridgeline’s only key edge. That strategic drilling contract has allowed the company to stretch those dollars and drill 1,300 metres at Carlin-East in 2019, a combined 5,636 metres at Selena and Swift last year, and still enter 2021 with a healthy treasury of $3.5 million to drill all four projects. As a 7.8% shareholder, Peters is incentivized to make sure those dollars go as far as possible. Management owns a combined 17% of shares and public companies — EMX, Vior and Ethos Gold — own another 19%. Institutions are at 12%.

HIGH-GRADE SILVER AT SELENA

At Selena, Ridgeline went looking for gold but found silver — wide intervals of oxide high-grade silver, along with lower-grade gold. The company hit paydirt with hole 21, which intersected 36.6 metres grading 67.08 g/t silver and 0.26 g/t gold (90.05 g/t silver-equivalent “AgEq”). The discovery followed two earlier programs that had encountered promising hits, including 3m of 823.5 g/t AgEq and 36.5m of 77.8 g/t AgEq.

Mineralization outcrops at surface and has good continuity, extending for more than a kilometre down-dip and along strike. “We are drilling wide-spaced step-out scout holes and they keep hitting,” Peters says.

On a gram-meter basis, Selena results compare favourably to other high-grade silver explorecos, including in Nevada, that have market capitalizations much higher than Ridgeline’s. Selena’s grades are also multiples of those at Coeur Mining’s Rochester open-pit mine in Pershing County, Nevada — America’s largest silver mine. Rochester’s proven and probable reserves average about 11.3 g/t silver and 0.085 g/t gold. Coeur is in the initial stages of building a major expansion of the mine.

Peters and Harp recently managed to acquire the historical drill-hole database for Selena from the 1980s. That data, combined with the new discovery, will help the team design the next drill program, which could launch in April if the weather cooperates. Early metallurgical testwork shows the silver and gold oxide mineralization is amenable to heap-leaching. It remains early days but Selena is shaping up to be a classic Nevada heap-leachable oxide deposit.

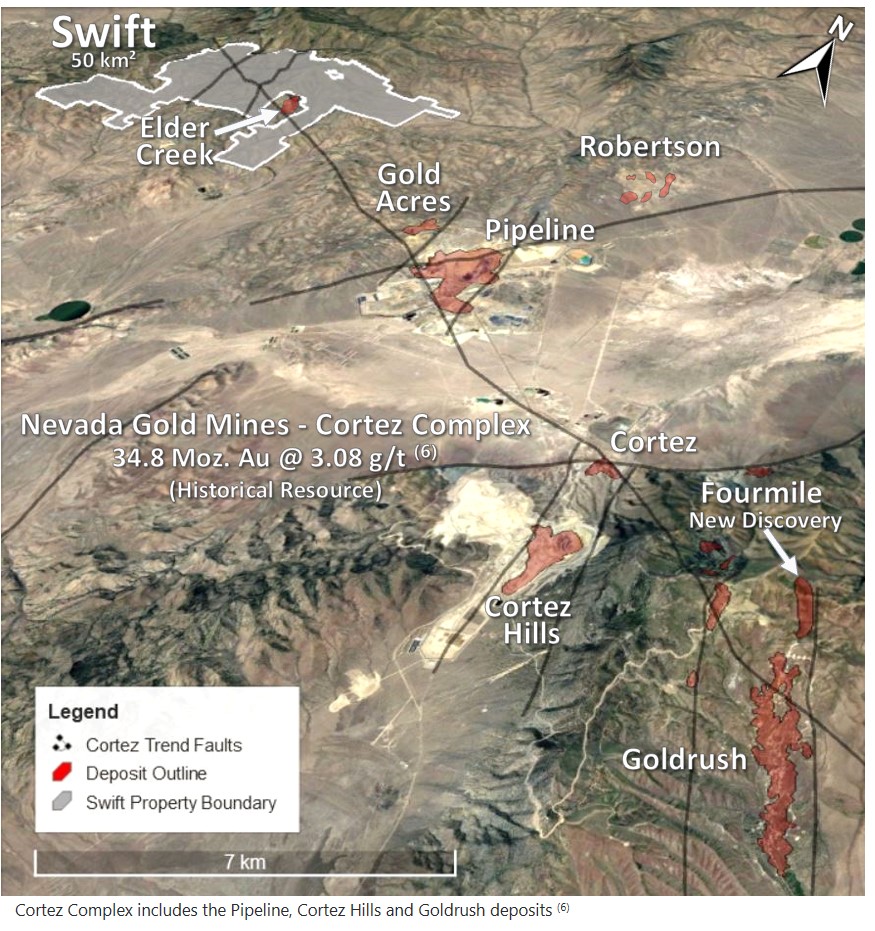

HUNTING A GIANT AT SWIFT

If Selena is a base hit in baseball terms, think of Swift as a home-run swing. It’s a Carlin-type gold project about 7 kilometres northwest of Nevada Gold Mines’ Cortez mine complex, which hosts about 35 million ounces at 3.08 g/t gold. The neighbourhood hosts large, high-grade Tier 1 deposits, which is what Ridgeline is looking for. Only five deep drill holes have ever tested the Lower Plate target rocks on the 50-square-kilometre property.

A three-hole, 2,413-metre drill program completed late last year hit widespread skarn alteration within favourable host rocks and produced some sniffs of low-grade gold and high-grade silver mineralization, including 0.2 metres grading 0.22 g/t Au and 860 g/t Ag. It’s an indication that Ridgeline drilled into the guts of the intrusive heat source — the largest Carlin-type gold deposits are associated with buried intrusives, Peters says. “If you’re too close, the gold won’t precipitate out. We now know where we are in the system, and we know where we’re going next.”

Two of the three deep holes intersected the favourable Wenban formation. It sounds like something out of a Star Wars movie, but Wenban is considered the primary host rock for much of the gold in Nevada’s Cortez trend, including 15 million ounces in NGM’s Goldrush deposit. Data from the Phase 1 drilling will help Ridgeline vector in on higher-grade gold mineralization in the Phase 2 program.

CARLIN-EAST/BELL CREEK CATALYSTS: LOCATION, LOCATION, LOCATION

Barrick CEO Mark Bristow has identified Nevada as “one of our main hunting grounds” and Barrick’s moves at the Fourmile discovery show those weren’t idle words. The company has rapidly advanced Fourmile — north of Goldrush — since announcing a maiden Inferred resource of 700,000 ounces of gold grading 18.58 g/t (Fourmile is outside the NGM joint venture).

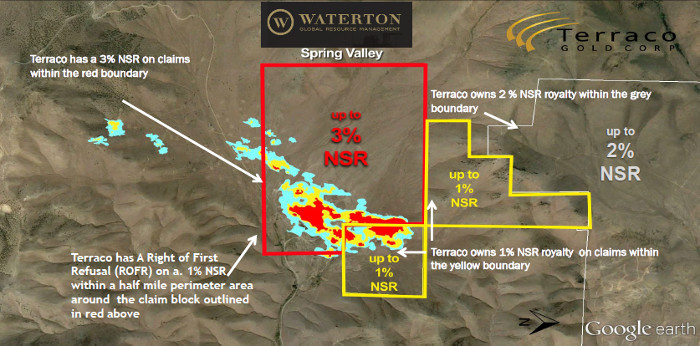

In resource exploration as in real estate, it’s all about “location, location, location.” And Barrick has been aggressively exploring on the doorstep of both Carlin-East and Bell Creek. Last year NGM intercepted 21.3 metres grading 35.3 g/t gold at its North Leeville target, north of the Leeville underground gold mine. That’s just 3 kilometres away from Ridgeline’s Carlin-East boundary, along the Leeville structural corridor.

Barrick-controlled NGM is also exploring aggressively just to the west of Ridgeline’s Bell Creek project. Assays are pending on a deep hole NGM drilled at its Sinkhole Breccia target just 250 metres to the west of Bell Creek. It’s valuable land — a 2020 Laurentian Bank analyst report on Ely Gold Royalties (ELY-V) assigns a US$41-million valuation to Ely’s REN royalties, which lie directly adjacent to Ridgeline’s 100% owned Bell Creek property, on the west.

Peters plans to drill both Carlin-East and Bell Creek but will watch Barrick’s next moves in the neighbourhood and proceed accordingly, while Ridgeline builds ounces at Selena and drills for a high-grade gold discovery at Swift.

Ridgeline Minerals (RDG-V, RDGMF-OTC)

Price: 0.36

Shares out: 48.1 million (58.5M fully diluted)

Market cap: $17.3 million

Disclosure: James Kwantes was compensated for the writing and distribution of this article. Kwantes owns shares of Ridgeline Minerals, purchased in the 22-cent financing round, the 45-cent IPO and the public market. This article is for information purposes and should not be considered investment advice. All investors need to perform their own due diligence.

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:  Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter:

Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter: