— FOR SUBSCRIBERS ONLY —

By Tommy Humphreys

Season’s Greetings Resource Opportunities subscribers.

2014 was another humbling year for junior mining investors, the fourth consecutive year of declining share prices, trading volumes and financing activity for early-stage mining shares.

Gold, long considered a leading indicator for the junior mining sector, ends the year roughly where it began, hovering around $1,200 per ounce.

The TSX Venture Exchange, a barometer for Canadian listed early-stage miners, now trades below 2008 financial crisis levels.

The situation has gotten especially bad for the promoters and officers of junior companies, many of whom have abandoned the sector for greener pastures in medicinal marijuana or technology. As a friend of many junior mining executives, I can tell you the situation is not pretty. Some execs have gone years without a paycheck, perhaps reflecting the value that was created. However even some talented geologists and financiers are finding paychecks hard to come by, which reminds us that the secret to life is a low burn rate.

This all means very little outside of Vancouver, Calgary, Toronto and maybe Perth. Investors who owned anything but mining shares have performed incredibly well since 2009.

And any investor in the sector who is not an insider might be relieved to know they are not alone in their suffering.

Recently, John Kaiser gave an excellent presentation entitled “Confronting the Extinction of a Canadian Institution”, available for download here, which I was able to discuss at length with John.

A big part of the problem according to Kaiser, and echoed by myself, is the financial system in Canada, which historically has been the hub for junior mining finance.

In the past, junior mining founders and stockbrokers would work in cahoots to create new companies. These brokers would keep the money flowing into the treasuries, so exploration and development work could take place. They also kept their clients long and, for the most part, in the dark.

Now that the fee-based wealth management model has overtaken transactional brokerage business, firms vigorously try to prevent their investment advisers from trading high-risk junior securities. Instead, they prefer any number of rubber-stamped mutual fund and index products.

The few brokers who still follow the venture model are a dying breed. Importantly, you don’t see a lot of venture brokers and teams from various firms working together. There is little to no junior mining stock talk at the stock brokerage water cooler anymore.

So what?

The net result is that the purging of the publicly traded early-stage mining sector is still in progress. A bail out from retail or institutional investors at this stage does not seem likely. The most active hands financing exploration and development are either very experienced, wealthy industry insiders, or corporates like larger mining firms.

This drastically reduces the amount of real work being done sector wide, which in turn makes the junior mining sector all the more easy to track, and should pave the way for an eventual recovery. Companies with money in the bank doing real work are now trading at exceptionally low valuations, historically. A focused portfolio of quality juniors should do very well as low commodity prices should eventually cure the sector from its epic four year hangover, and a wave of consolidation replenishes depleting reserves across the mining industry.

Where do we start 2015?

The consensus from industry veterans in our network is that large cap miners need to recover before the junior sector takes off. Next will go the developers, and finally, some explorers.

I can only tell you what I am doing, and as a 29-year-old my risk tolerance is overly aggressive for many readers. My investable assets are about half in cash, a quarter in quality junior developers, and a quarter in several speculations that I keep a small position in to keep me interested and on top of a wide list of stories. Should any of these names start to break out we can always add to them.

This publication has never been about big cap miners, as they are well covered by investment research houses. The broker that I use, Jonathan Jones at Haywood Securities, can help subscribers looking for research on larger stocks (jjones@haywood.com would be happy to hear from you).

On the developer side, I am sitting with sizeable long positions in Ivanhoe Mines, Kaminak Gold and now Lundin Gold. Each of these stories is attractively priced and shows potential for large risk-adjusted returns. Even so, they could get cheaper. When I returned from an Ivanhoe Mines site visit earlier this year, I wrote that junior mining investors should be prepared to average down in the future. That continues to remain the case (so don’t go and buy your entire position in a junior company on one day, as they are volatile).

On the more speculative side (not that all juniors aren’t speculative), I built a long position in North Arrow Minerals (NAR.V), which could have a transformational start to 2015. The company is scheduled to release bulk sample results and a diamond valuation from its Qilalugaq project in early Q2, and should be drilling its Pikoo project in that same timeframe. See our August 26 report on North Arrow for more. NexGen Energy (NXE.V) is advancing their high-grade Arrow uranium discovery in the Athabasca Basin. NexGen’s team is one that I admire for their technical approach to the discovery and there is a considerable delta between the company’s current market cap and what an economic uranium deposit is worth in the area, so I stay faithfully long. I continue to hold Pure Gold Mining (PGM.V) as they have a legitimate home run shot at gold-mining’s best address. My peers at CEO.ca also hold Pilot Gold (PLG.V) and True Gold (TGM.V), which share management with Pure Gold and boast excellent, well financed projects.

Among the more grassroots names, Cordoba Minerals (CDB.V), a Colombian base metals and gold prospector, is interesting. The company raised $15 million at $1 per share in March 2014, had a strong exploration season, and now trades at $0.105, which might make this company our top trading pick for this tax loss season (I was a buyer last week at $0.11 in a small way), but it’s not for the faint of heart. Cordoba will close off the year with a roughly $6 million market cap and $4 million in the bank, which management says should last them until the end of next year. The company has found several copper gold porphyry showings in a very mining friendly part of Colombia. More work is needed to prioritize targets and find something bigger. The company has an excellent exploration team and shareholders like Blackrock, RBC Asset Management and Geologic Resource Partners. I would like to see more news flow in general from the company, starting with next year’s exploration plans. While dilution can kill any seemingly undervalued pre-revenue company like Cordoba, this is one that I perceive to have $0.11 per share in downside and multiple dollars of upside should they prove to the market they have large-scale porphyry potential and become better at communicating to investors over the next few years.

Colombian junior miners have suffered in the market because of perceived instability and permitting issues. I have been to the country three times over the past year and think these concerns are overblown, and note that FARC recently announced a cease-fire for the first time in some 50 years. According to management, 2015 should see permits in hand for Red Eagle Mining’s San Ramon project, a relatively simple proposed underground mine near Medellin. Nearby, Continental Gold’s impressive high-grade Buriticá project may also receive its permits this year. These events should not only be value drivers for these two companies, which I also own, but also for the entire Colombian mining space.

There will be a couple of new company initiations in early 2015. Kaizen Discovery (KZD.V) is a Robert Friedland and ITOCH-backed explorer with seemingly unlimited financing capability and an impressive technical team. The shares have come under considerable pressure over the past year, despite impressive progress. Expect a full report on the company by the second week of January. In the zinc space, we’re also working on a report on Utah-based junior, InZinc Mining (IZN.V). Second week of January for that one.

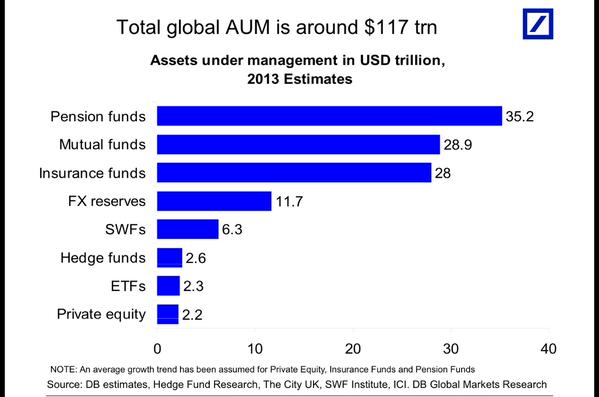

A tweet this morning from Joe Weisenthal at Bloomberg illustrates just how much global capital is out there (approx $117 trn). Portfolio managers tend to be sector allocators and when commodities go “on” again, we expect to be sitting pretty in these thinly-traded securities.

We continue to look for mining executives with staying power to develop projects and market their stories aggressively over the next several years. Those teams will find the rocks and the money to create value in this space again.

We are incredibly grateful to have you as subscribers, and wish you a very Happy Holidays.

Thanks and sincerely,

Tommy Humphreys

CEO.ca and Resource Opportunities.

Company Updates:

Petroamerica Oil (PTA.V)

I am humbled and poorer for initiating coverage on Petroamerica Oil (PTA.V), the first oil stock covered in Resource Opportunities following the October 9, 2014 Subscriber Summit in Vancouver and before the now obvious oil price fall. To put the recent crude crash into perspective, global production is around 92 million barrels a day, and the current surplus is expected to be just 500k to 1 million barrels. This roughly 1% oversupply has sent oil prices crashing nearly 50% in just a few months. Overkill? I think so, but as my colleague Keith Schaefer points out, the market always sells uncertainty.

Back to PTA, I spoke to management last week, and frankly, at roughly $50-60 oil, the focus is on survival. The company will release a revised budget and production forecast in early January, at which point we should be able to get a better picture of what’s to come. They will close off the year with over $50 million in the treasury. Last week, PTA announced a decision to case and test the Langur 1 exploration well in Colombia’s Llanos Basin, where most of PTA’s production comes from, with results expected before the end of the year. The well hit 15 feet of net pay with no water contact and the pay zone could extend to a large area. The market will be hoping for encouraging test results. Any production from this block will be subject to 8% royalties, which is lower than the 27% they pay at the adjacent Las Maracas field, until production reaches 5 million barrels.

The company’s JV partner, Vetra, has also drilled another successful well in Colombia’s Putomayo Basin with the Quinde 3 well. Management are watching costs and note that lower crude prices could also lower operating costs (cheaper fuel for transport and diesel for power generation). We will know more from January’s guidance news release but this remains a cheap stock and a management team we admire.

Expecting PTA to be well positioned for success when oil prices recover, I have been averaging down between $0.14 and $0.16 over the past week, and have stink bids in at lower prices in case we get the opportunity.

Price: $0.15

Shares Outstanding: 872.52 M

Market Cap: 131 M

Contact Investor Relations

(phone 403-237-8300)

http://www.petroamericaoilcorp.com

Midway Gold (MDW.T)

Midway is interesting at these levels as they are about to reach first production from the PAN mine in Nevada at the end of January. In the past, and not always, a re-rating occurs when a mining project enters production.

The 2011 feasibility study for the PAN project shows a 32% IRR at $1,200 gold so this project can definitely weather a weaker gold price environment while having significant leverage to rising precious metals prices.

Once PAN is up and running, Midway has two excellent development projects that are next in the pipeline. The Gold Rock project is 10 km away from PAN, and is similar to PAN in that it is a potential open pit, heap-leach, and low CAPEX operation. Production there is targeted for 2017.

The third project is Spring Valley which is being developed by Barrick Gold, which is the operator and owns 75% of the project. Midway’s 25% of the project is fully funded to construction. The project has over 4 million ounces in all categories and Barrick believes it has the potential to be a standalone gold mine.

Midway hit a high of $1.60 in 2014, which is double the current share price. With a strong start to production and a little help from the gold price, Midway is set up for a solid year in 2015.

Price: $0.76

Shares Outstanding: 174.92 M

Market Cap: $132.94

Contact Investor Relations

(phone #720-979-0900)

http://www.midwaygold.com

Ryan Gold (RYG.V)

Ryan Gold is strictly a cash rich shell play. Named after famed Yukon prospector Shawn Ryan, Ryan Gold was a hot exploration stock a couple of years back when the Yukon was enjoying one of its periodic exploration renaissances (now over). Ryan Gold has stopped all exploration activity but is sitting pretty on a cash position of $21.2 million with $172,000 in liabilities as of September financials.

At 10 cents, the company’s current market cap is $11.7 million, which essentially means that you are buying the stock at a $10 million dollar discount to cash.

The hope here is that management will successfully make an accretive acquisition with the cash, and in this market there should be no shortage of potential bargains. Ryan Gold has recently appointed (on December 10) Mark Goodman as CEO, so things could be progressing in regards to a transaction. Mr. Goodman is the son of legendary mining financier Ned Goodman and we expect the Goodman’s to be able to come up with something good for this deal.

Ryan Gold hit a high of 17.5 cents in 2014 and has not done much in the last three months. We would be happy picking it up at its current level and selling for a 3-4 penny move (30%-40%) in 2015.

Price: $0.11

Shares Outstanding: 117.14 M

Market Cap: $12.9 M

Contact Investor Relations

(phone # 604.630.6889)

http://www.ryangold.com

Editorial Policy, Disclaimer and Disclosure: Resource Opportunities is written, edited and published by Tommy Humphreys, 602-1228 Homer St., Vancouver, BC, V6B 2Y5. Tel: 1-877-972-3387 www.ResourceOpportunities.com

Editorial Policy: Companies are selected for presentation in this publication strictly on the merits of the company. No fee is charged to the company for inclusion. Currencies: Dollar and $ refer to US dollars, unless stated otherwise or obvious from the context (for example, a share price on a Canadian exchange). Readers are advised that the material contained herein is solely for information purposes. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. Nothing contained herein constitutes a representation by the publisher, nor a solicitation for the purchase or sale of securities. The information contained herein is based on sources which the publisher believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available data. Any opinions expressed are subject to change without notice. The owner, editor, writer and publisher and their associates are not responsible for errors or omissions. They may from time to time have a position in the securities of the companies mentioned herein, and may change their positions without notice. (Any significant positions will be disclosed explicitly.) Author is not a registered investment advisor and this is not a formal investment recommendation. We are not telling you to go buy or sell this stock. We are telling you that we bought this stock and that we highly recommend that you research the stock to see if it is a good fit in a well-diversified portfolio. We recommend that you do as much research as possible on every stock you purchase or sell prior to any action. We recommend that you consult your investment advisor or broker prior to any action. We are not liable for any transactions you make after reading this article. Do your own due diligence prior to making any investment decision. Additionally, we invest with a 12 month or longer time horizon. If your time horizon is shorter, you may consider other investments.

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:  Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter:

Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter: