Originally published Sept. 16 for Resource Opportunities subscribers. Join us as we uncover the best investment ideas in the junior mining universe! Only $299 for 1 year and $449 for 2 years.

IDM Mining (IDM-V) site visit

By James Kwantes

Editor, Resource Opportunities

Getting to IDM Mining’s Red Mountain gold project in northwestern British Columbia wasn’t quite “planes, trains and automobiles,” but it was close. First I flew from Vancouver into Smithers. There’s some family history in the neighbourhood — down the road is Houston, where my grandfather settled with his family after emigrating from the Netherlands. There’s some family history for IDM CEO Rob McLeod, as well.

From Smithers it was into a rental car for the 330-kilometre trek to Stewart, nestled beside the Alaska panhandle. Jagged mountain peaks and tall waterfalls make the final approach beautiful.

A helicopter picked me up for the last leg to Red Mountain, 15 kilometres northeast of Stewart. It was a cloudy day, so the pilot had to take the “long way,” threading his machine through the Bitter Creek Valley to the site. It’s the same route the road will take from Stewart — in the helicopter, it was still only about 10 minutes.

Red Mountain mine workers would have an easier commute — a 45-minute trip by road to the mine site. IDM is working on a feasibility study as it plans a small, scalable high-grade gold mine at Red Mountain. Previous owners have sunk more than $45 million into the project, including construction of a portal and ramp into the mountain to access mineralized zones.

IDM Mining is named for Rob’s father Ian and his uncle Don McLeod, underground miners who explored and mined some of the most well-known deposits in northwestern British Columbia and beyond — including Pretium’s Brucejack. Stewart, Rob’s hometown, was a mining hub for much of the 1900s. Now, its decline is reflected in abandoned storefronts and empty houses.

But “the times, they are a-changin.” IDM’s Red Mountain is part of a mining revival backed by the pro-mining provincial government. One of the visible indicators of the shift is the 287-kilovolt Northwest Transmission Line, parts of which hug Highway 37 as it snakes its way north.

The $500-million power line was built by the B.C. government to open up the remote northwest of the province to mining and industrial development. The first operation to tap into it is Imperial Metals’ Red Chris open-pit copper mine, which began mining in early 2015. IDM’s operation won’t tie directly into the line. But the implications of the power boost are far-reaching for all of the juniors and development companies operating in the heavily mineralized region.

And if you pay attention on the drive to Stewart, there are also signposts — literally — highlighting IDM Mining’s advantage. Those are the signs advertising the King Edward Hotel in Stewart, which Rob’s father Ian owned and operated for many years. The family sold the hotel a few years back, but it speaks to McLeod family roots in Stewart.

For McLeod, Red Mountain is personal. As he put it to me in a conversation some time ago, “This is our turf.” An operating mine near Stewart would mean work close to home for friends in the industry who have been navigating the bear market by flying wherever there is work. It’s an intangible that doesn’t factor into financial or economic models, but I believe it’s significant.

It takes a team to build a mine, and another key component is IDM’s executive chairman, Michael McPhie. He’s a veteran operator who has served as CEO of the Mining Association of B.C. and chairman of industry group AME BC. He’s currently managing director of JDS Gold. They say a photo is worth 1,000 words. The one on IDM Mining’s home page features McLeod, McPhie and Jeff Stibbard, who runs JDS Energy & Mining (currently working on IDM’s Red Mountain FS).

As I approached Stewart in the rental truck, the bugs arrived, and their pitter-patter on the window almost sounded like drizzle. Soon enough the rains came, and then the mountains — towering giants casting off waterfalls and glaciers. Just outside the port of Stewart, another sign of changing times. The highway closed temporarily to northbound travellers to allow through a convoy of trucks transporting giant wind turbine parts to a large wind farm project outside of Tumbler Ridge, in northeastern B.C.

It was near nightfall when the helicopter pilot and I arrived at the Red Mountain camp. I stayed in one of the comfortable pods, complete with heater.

My visit wasn’t long but we covered a lot of ground, after a geological briefing at the camp’s nerve centre. The first foray was up the mountain (in a helicopter) and underground, into the access ramp. Haul trucks will transport ore between the underground workings and the mill, located below the camp in an area called Bromley Humps.

The tunnel was in good shape, with little evidence of rock fall, despite being largely abandoned for most of the 20 years since it was blasted out by LAC Minerals. In addition to the portal and underground workings, IDM inherited mining equipment including some of the haul trucks that will go underground.

During the visit, IDM was dewatering in the two kilometres of existing underground workings. The company was also drilling underground — a step-out from the Marc Zone that was outside the resource envelope. The geo in charge of that hole was so enthusiastic about the rocks she stayed up the mountain late that night to collect more core. Subsequent assays, reported Sept. 6, backed up her optimism.

Hole U16-1185 intercepted 14.19 metres (true width) of 5.78 g/t gold and 24.15 g/t silver. Another Marc Zone step-out hit 13.77 metres (true width) of 5.72 g/t Au and 34.89 g/t Ag. There was also a discovery hole of 6 metres grading 7.43 g/t Au and 12.51 g/t Ag. The latter was a step-out hole below the Marc Zone and 70 metres outside the resource as currently defined. The area has been dubbed the NK Zone (after assistant project manager Natalie King).

It was gusty and raining atop Red Mountain before we descended into the darkness of the access ramp, offering a glimpse at what winter must look like when the white stuff is blowing. It’s why IDM plans to mine for 8 months and shut down during the worst 4 months of the year, stockpiling the rest of the ore at a mill further down the mountain that will operate year-round (The initial plan called for the entire operation to be shut down for 4 months). The mill is several kilometres closer to Stewart than the main ore body.

In July IDM released an updated PEA with better economics than the 2014 iteration as well as a new tailings location. IDM now plans to process 1,000 tonnes per day year-round based on underground mining rate of 1,500 tpd for 8 months annually. That change increases the amount of gold produced over the 5-year mine life — from 277,000 Au oz to 348,000 oz and 852,000 Ag oz to 965,000 oz.

But it also increases capital costs both at the mill and the underground workings, where the company will be accessing more remote mineable resources. Pre-production capex is pegged at C$111.2 million, compared to $76.1 million in the previous study. After-tax IRR remains above 30%, helped in part by the weaker Canadian dollar (80-cent exchange rate, compared to 95 cents in 2014).

The past five years have been a grim time for mining companies, which may allow IDM to further reduce capex through the purchase of mothballed equipment. Victoria Gold (VIT-V) in the Yukon illustrated the potential earlier this year when it purchased a 100-person all-season mining camp for $275,000, saving millions of dollars. Victoria’s feasibility study was completed by JDS, the same company doing IDM’s (the FS is slated to land in the first quarter of 2017).

Lost and Found

Glacial retreat is an important part of the IDM story. And a helicopter trip into nearby Lost Valley, IDM’s recent high-grade discovery, shed some light on why McLeod believes the 5-year mine life could be just the start for Red Mountain, a 17,000-hectare property.

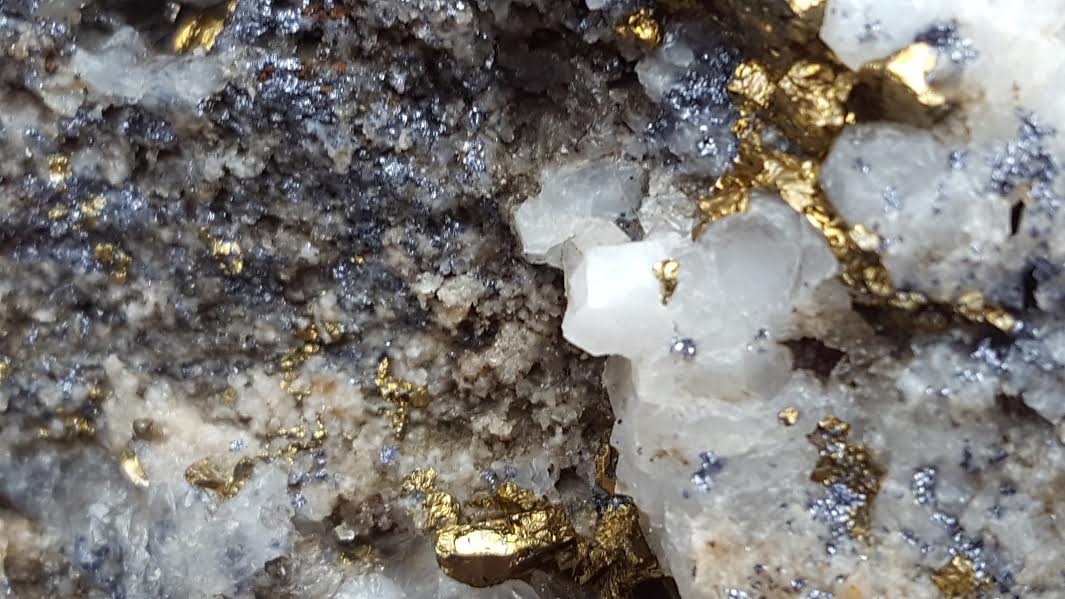

IDM had announced the new Lost Valley discovery a few days before my visit. Through surface mapping and sampling, geologists discovered a zone of veining and shearing hosting high-grade gold-silver-molybdenum mineralization. Of 66 samples, 22 assayed above 3 g/t gold, averaging 30.45 g/t Au. High grades of silver and molybdenum were also assayed, as well as rhenium.

Mineralization in Lost Valley has been exposed by the rapid melt of the Cambria icefield, which left behind boulders atop cliffs and strewn across the valley bed when it retreated. The glacier covered the area just 20 years ago when McLeod was a junior geologist on the project. It’s about 4 kilometres southwest of the main Red Mountain mineralization and 800 metres lower.

The pilot dropped off the two of us and McLeod’s Vizsla companion, Petal, on the rugged terrain and we hiked up to some outcrops. The mineralization was impressive, with the dull shine of pyrite (“fool’s gold”) and the blue hues of molybdenite hinting at the geological potential (there’s a major moly deposit, Kitsault, 55 kilometres to the south).

News has flowed fast and furious since my site visit, for both Lost Valley and the main Red Mountain ore body.

Aug. 24 – IDM released assays from surface trenching at Lost Valley that revealed a high-grade structure, confirming earlier grab sample results. The new high-grade zone was dubbed Anda’adala’a Lo’op zone, Nisga’a for “money rock.” Seven channel samples taken along a 33-metre trench averaged 18.7 g/t gold and 61.2 g/t silver over an average width of 0.84 metres. Mineralization in Lost Valley has been traced over a 1-kilometre by 1.2-kilometre area.

Sept. 6 – Assays from 13 Red Mountain underground core holes mentioned above, including 14.19 metres of 5.78 g/t Au and 24.15 g/t Ag.

Sept. 12 – IDM announced the discovery of another zone 100 metres south of the Anda’adala’a Lo’op zone. This one was dubbed the Randell Zone after geologist Andy Randell, who had just arrived to prospect at Lost Valley as I was leaving. A 9.35-metre channel sample returned an average of 22.2 g/t Au and 81.3 g/t Ag, including .85 metres of 133.25 g/t Au and 378 g/t Ag. Very impressive grades, even after removing the .85-metre intercept.

Sept. 29 – On the regulatory front, the public consultation period for environmental assessment of the Red Mountain underground project will run from Oct. 5 to Nov. 4. IDM plans to file a project application report with both the B.C. Environmental Assessment Office and the Canadian Environmental Assessment Agency in early 2017. Feasibility-level engineering work is also underway at the site, led by JDS Energy and Mining Ltd.

Oct. 4 – IDM closes an upsized private-placement financing for $8,994,707, consisting of 17-cent hard-dollar units and 21-cent flow-through shares. Proceeds will be used for additional resource expansion drilling, exploration and permitting at Red Mountain, including feasibility study work.

Drilling, dewatering, development, permitting and a feasibility study expected in the first quarter of 2017 — it all requires money, and that means more dilution. IDM has shown there is demand for their shares — the recent private placement started at “up to $5 million” and finished at almost $9 million. Those shares take IDM’s already high share count to about 270 million. But crucially, the financing also allows IDM to pay for permitting and development as well as exploration at Lost Valley.

In its latest NR, IDM announced that drills will be turning at Lost Valley within the month. If the company can drill high-grade there in a rising gold price environment, the share price should take care of itself despite the amount of paper out. Longer-term, Lost Valley is shaping up to be a potentially significant source of ounces for a mine at Red Mountain. A final investment decision is slated for the end of 2017, with commercial production targeted for the end of 2018.

The next key step is the feasibility study, and a producing gold mine is the goal. If IDM can execute on exploration while navigating the development path to a gold mine, the company will capture the two sweet spots of the “Lassonde curve” — the life cycle of a junior mining share (pictured). Shareholders make the most money during discovery and, beyond the development stage, production.

IDM currently trades at a market capitalization just over $50 million. Despite recent gold price weakness, we’re into the kind of market where those types of valuations are being assigned to promising drill plays. Red Mountain is delivering both with the drill bit and on the development front. I like the company’s odds of delivering a small, high-grade gold mining operation with a five-year mine life that is extended as more ounces are discovered elsewhere on the property.

McLeod and McPhie launched the company during the depths of the bear market and the upturn has given them the leverage to build a near-term production story. There aren’t many of those in the gold sector. At these levels, the stock is an attractive call option on IDM growing a gold business and making additional discoveries.

Price: .19

Shares outstanding: 270 million (380M fully diluted)

Market cap: $51.3 million

Treasury: $15 million

IDM Mining CEO Rob McLeod will speak more about plans for Red Mountain and Lost Valley at the free Subscriber Investment Summit today at the Pan Pacific Hotel in Vancouver. If you’re attending, stop by and say hello!

Disclosure: Author is long IDM Mining shares and the company became a Resource Opportunities sponsor subsequent to this site visit. This article is presented for informational purposes only and should not be considered investment advice. Junior mining investments are speculative and not suitable for many investors. Always do your own due diligence. Nothing contained herein constitutes a representation by the publisher, nor a solicitation for the purchase or sale of securities. The information contained herein is based on sources which the publisher believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available data. Any opinions expressed are subject to change without notice. The author and their associates are not responsible for errors or omissions.

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:  Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter:

Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter: