By James Kwantes

Resource Opportunities

Well-run project generators are brick houses in a speculative corner of the market, where the winds of commodity prices and dilution are often house wreckers. Their share prices are typically backstopped by healthy treasuries, royalties and equity stakes, as well as extensive claims holdings. They are businesses, not cash-burning lottery tickets like most junior explorecos.

But for many speculators, that level of diversification is a knock. Those bricks provide stability but weigh down the “rocket ship” when a junior exploration company hits a bona fide high-grade gold discovery. Project generators typically retain only limited exposure to discoveries through royalties or small equity stakes.

The picture changes completely, however, when project generators make a high-grade discovery on a wholly owned project. Azimut Exploration (AZM-V) proved it in January with their Patwon gold discovery at the Elmer property in Quebec. Azimut is Quebec’s largest claims holder, diversified across metals and known for its technical savvy. On January 14, the project generator announced multiple high-grade gold intercepts at the James Bay project, including 12.43 g/t Au over 6 metres and 27.36 g/t Au over 4.7 metres.

The day before the discovery was announced, Azimut shares closed at 50 cents (@ $31M market cap). The stock rocketed to $1.50 the following day and remains at about that level, despite the uncertainty and tough market conditions that persist in the junior mining complex. COVID-19 forced the suspension of Azimut’s follow-up 6,000-metre diamond drill program at Patwon.

Azimut closely resembles another project generator with a wholly owned gold project that will be drilled this summer: Strategic Metals (SMD-V, SMDZF-OTC). Strategic, Yukon’s largest claims holder, is cashed-up to drill its Mount Hinton high-grade gold prospect in the Yukon Territory’s Keno Hill district. Strategic plans to spend about $3 million to explore Mt. Hinton this season, including up to 6,000 metres of drilling (diamond and RAB).

The program, of course, is dependent on how the Coronavirus pandemic plays out in the coming months. In Yukon, mining and exploration have been designated an essential service.

Strategic shares currently trade at about 35 cents, for a $34-million market capitalization. It’s a far cry from the $4.35 level ($381M market cap) that the stock hit in 2011. That share price was propelled by gold’s rise to US$1,900 an ounce — less than $200 an ounce higher than current levels — as well as ATAC’s high-grade gold discoveries at the Rackla property in Yukon (ATAC is part of the Strategic Exploration Group).

Doug Eaton (right), Strategic’s CEO and principal of Archer Cathro, the storied Yukon geological consultancy, was in the thick of it during ATAC’s high-grade discoveries.

Doug Eaton (right), Strategic’s CEO and principal of Archer Cathro, the storied Yukon geological consultancy, was in the thick of it during ATAC’s high-grade discoveries.

But the veteran geologist says he’s more excited about Mount Hinton because of the volume of high-grade gold found at surface at such an early stage, during what appears to be a perfect storm for the gold price.

“Mount Hinton is the same kind of setup but the project is much more readily accessible than Rackla and it’s earlier-stage,” Eaton said. “It’s much more exciting than ATAC was at this stage. We have a chance of a major gold discovery under the till or talus.”

Eaton’s comments about Mount Hinton’s possibilities sound like fairly typical Howe Street-style promotion. But a couple of key differences make his observations worth a closer examination:

- His comments say much more about Mt. Hinton’s prospectivity than they do the potential of ATAC’s Rackla project. Strategic holds a 6.4% stake in ATAC and is incentivized to see the company succeed. Eaton remains a believer that the Rackla deposits will one day produce tens of millions of ounces of gold.

- Eaton, a geologist, has been working in the Yukon for almost 50 years. He has an almost-encyclopedic knowledge of Yukon mining projects, which helps Strategic snap up forgotten but highly prospective projects. Eaton has been involved in several of the Territory’s major discoveries, including the Casino copper-gold porphyry (now being developed by Western Copper and Gold).

REWIND: In the summer of 2017, Strategic sold six properties including Mt. Hinton to a private company called Territory Metals. The terms of the deal hinted that Mt. Hinton was no ordinary prospect — in addition to a 2% NSR, the agreement included a 10% NSR on any small-scale high-grade gold production and a $1.5-million milestone payment if Territory identified a 1-million-oz gold equivalent resource on any of the properties.

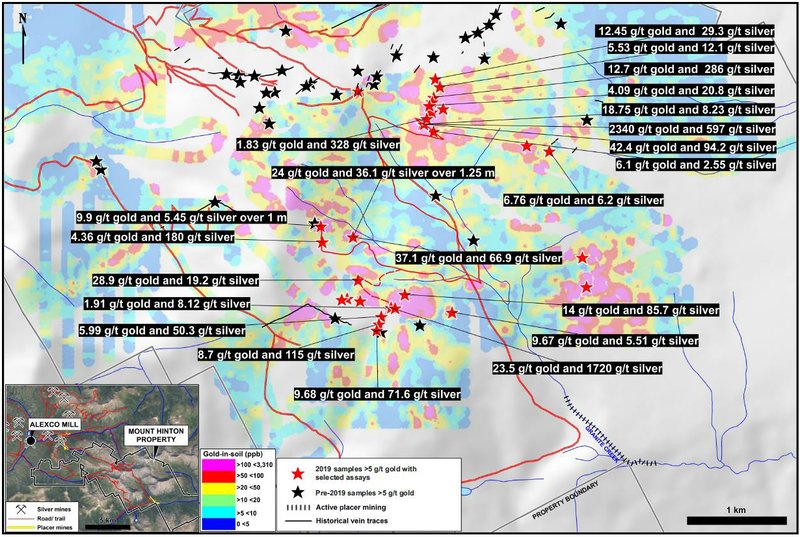

Territory’s go-public plans fizzled and Strategic got the property back. Archer Cathro geologists hit the ground hard in summer 2018. They extended a large geochemical soil anomaly and found multiple rock samples with high-grade gold samples that assayed greater than 9 g/t gold.

Last summer, Strategic hit paydirt with a prospecting program focused on the 3.5-km by 1.5-km gold-in-soil anomaly. One rock sample came back with a bonanza-grade assay: 2,340 g/t gold and 597 g/t silver. Follow up prospecting discovered visible gold at this site (the first reported native gold on the property) and subsequent samples containing visible gold were not assayed. Other chip samples also carried high gold and silver values, including:

- 42.4 g/t gold & 94.2 g/t silver

- 9.9 g/t Au & 5.45 g/t Ag over 1 m

- 24 g/t Au & 36.1 g/t Ag over 1.25 m

- 23.5 g/t Au & 1,720 g/t Ag

- 202.0 g/t Au & 2,020 g/t Ag

The property has not seen much exploration despite its proximity to Alexco’s Keno Hill project — Mt. Hinton is just three kilometres south of Alexco’s Bellekeno deposit. That’s largely because of road access difficulties. But the situation has improved dramatically in recent years thanks to the thriving Granite Creek placer gold camp, located at the base of Mount Hinton. Two placer operators are pulling out multi-ounce gold nuggets and the Granite Creek drainage has become one of Yukon’s hottest gold camps.

Strategic brought in excavators last year to build a road network on the property, an effort that will continue this year once the snow melts. The planned 6,000-metre drill program is a large one for Strategic but so is the size of the potential prize. “To find this material at surface is remarkable,” Eaton remarked. Strategic geologist Steve Israel has now mapped three separate phases of mineralization on the property. More phases means higher volumes of mineralizing fluids, which can lead to more gold.

With Mount Hinton a potential near-term catalyst, Strategic’s share price — and downside — is backstopped by a healthy treasury of $6.8 million and large equity stakes, as well as its extensive Yukon claims portfolio. Significant equity stakes include:

- ATAC Resources (6.4%): high-grade gold deposits on the Rackla property

- Rockhaven Resources (36.3%): h-g 1.2M oz Au/28M oz Ag deposit, on a road

- Terra CO2 (62.6%) – pending patent on non-CO2 generating cement replacement

- Precipitate Gold (24.3%) – Barrick just signed a 70% earn-in agreement for Precipitate’s Pueblo Grande project beside Barrick’s Pueblo Viejo mine in Dominican Republic

- Silver Range Resources (17.7%) – project generator focused on high-grade prospects in Nevada, NWT, Nunavut

With gold moving in the right direction, the Mt. Hinton drill program positions Strategic to capture the shareholder value that can result from a high-grade discovery. It’s an outcome Eaton has seen before — and why he kept Mt. Hinton in the portfolio when it came back, rather than optioning it.

With gold moving in the right direction, the Mt. Hinton drill program positions Strategic to capture the shareholder value that can result from a high-grade discovery. It’s an outcome Eaton has seen before — and why he kept Mt. Hinton in the portfolio when it came back, rather than optioning it.

“We’ve turned down some pretty good offers for Mt. Hinton,” he remarked. “That’s because everybody wants 100% of it.”

Gold is on the move as governments around the world fire up currency printing presses to counter the economic effects of COVID-19. That lift has not yet translated to the junior sector, despite gold hitting all-time highs in most major world currencies. Eaton believes the malaise of the past several years is partly a generational phenomenon — younger retail investors simply haven’t experienced the large multibagger wins that tend to drive money into the junior space.

“You have a generation of investors who have done well in mining but who are too old,” Eaton said. “The generations of younger investors haven’t benefited the way people who are older did in prior bull markets.” That may be about to change.

A high-grade gold discovery at Mount Hinton could trigger a rush to get into Strategic shares, if the action on Aug. 21, 2019 is any indication. That day, Strategic announced high-grade assays including the bonanza-grade rock sample. The stock shot from 39 cents to 47 cents on multiples of average volume. It could be just a taste of what’s to come if Strategic drills a high-grade gold discovery at Mount Hinton this summer.

Strategic Metals (SMD-V, SMDZF-OTC)

Price: 0.35

Shares out: 96.6 million (108.85M fully diluted)

Market cap: $33.8 million

Disclosure: I own Strategic Metals shares and Strategic is one of three Resource Opportunities sponsor companies. This article is not intended as financial advice and all investors need to conduct their own due diligence and/or consult an investment advisor.

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:  Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter:

Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter: