News that the US Federal Reserve may begin cutting back on Quantitative Easing panicked investors around the world. The mere suggestion that the easy money might be cut back if the economy continues to improve exemplifies how dependent investors have become on what is effectively a government handout.

The sharp drop in the gold price resulting from the Fed comments had a hugely negative impact on resource stocks generally. There may be further downside for many companies as investors globally have taken a decidedly bearish stance on everything related to resources.

At some time, that sentiment will begin to reverse, as prices have fallen to irrationally low levels for many companies. In the meantime, we are looking for companies that are generating news of suitable magnitude that it might impact share values.

Following are some excerpts from a talk that I was invited to present at a conference in Australia. These comments summarize my current view of the resource markets.

The Current State of the Resource Markets

Excerpts from a presentation by Lawrence Roulston to the Africa Mining & Investment Conference, Sydney, Australia, June 24-25.

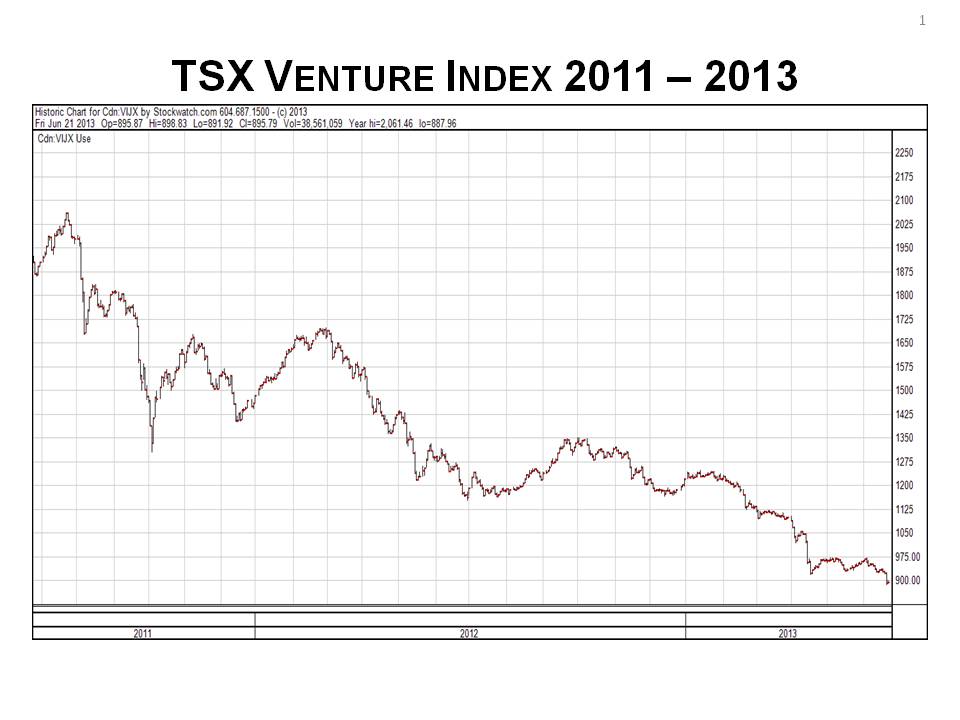

This is the Toronto Stock Exchange Venture index over the past two years. It is not a perfect measure of junior resources, but it is certainly a pretty good indicator for the junior resource market, at least in North America.

When you look at what has happened in the junior mining sector over the past couple of years, you have to wonder why anyone would invest in this industry.

It is easier to understand why people are interested in junior resources when you look back a little further. Here’s the Venture index going back a decade.

From 2003 to 2007, the TSX Venture index gained three-fold.

From 2009 to 2011 the index once more tripled.

That is the average across the industry. The top performing companies did much better than the index on average.

Clearly, this is a cyclical industry. Investors who buy on the dips and sell at the tops stand to make huge profits.

Let’s try to understand the recent drops:

We all know what happened in 2008. After the Global Financial Crisis, the junior resource sector bounced back pretty quickly.

It is less obvious what happened over the past two years. Reasons that have been cited include:

- Concerns that slower global economic growth would cut demand for metals.

- A general aversion to risk among investors globally.

- The terrible performance of the large mining companies.

In fact, the most significant factor was the terrible operating performance of the junior mining sector itself. Over the three-year period beginning in 2009, companies listed on the TSX Venture exchange raised $26 billion of new shareholder equity. The majority of that money was spent with little to show for it. For shareholders of those companies which spent their money with no results, it is like holding a lottery ticket the day after the draw.

Clearly, those companies with no real assets and no cash are being dumped by investors. Investment funds are facing redemptions and they want to get rid of these shares for whatever they can get. They just want them off their books. Many of them want to forget they ever heard of mining.

Unfortunately, the good companies are being dumped along with those companies which have no real value. That has created exceptional opportunities for those who can differentiate among the companies.

Some of these junior resource companies – those with good projects – have enormous value, even if that value is not presently being recognized by investors. Demand for metals continues to increase, even at this time of slow global growth.

- cheap jordan 2018

- cheap trainers

- best fake yeezy boost 350

- cheap jordans free shipping

- cheap nike air max

- cheap yeezy boost 350

- cheap jordan 6

- cheap nike trainers

- cheap yeezys

- cheap jordan 11

- cheap trainers uk

- replica yeezys

- cheap jordans size 14

- nike air max 90 black

- cheap yeezys shoes

- cheap jordan 11 low

- cheap nike trainers uk

- cheap yeezys

- cheap jordans

- cheap nike air max 90

- yeezy cheap

The reason for the on-going growth in demand is that the developing economies use a great deal more metal per unit of economic activity than do the mature economies. Demand for metals is rising and it will continue to rise. All of the talk of China slowing down: The most important metal consuming nation continues to use 7% more metal every year.

Even if there was no new demand, the mining industry would still need to construct new mines. Think about this: A typical mine has a life of about 20 years. That implies that the mining industry needs to replace half of its productive capacity every decade just to maintain the present level of output.

It’s getting harder to find new metal supplies: The big low grade deposits that were sticking out of the ground have been found, developed and are now largely mined out.

The junior exploration and development companies are becoming ever more important to the mining industry as the majors continue to scale back their own exploration efforts.

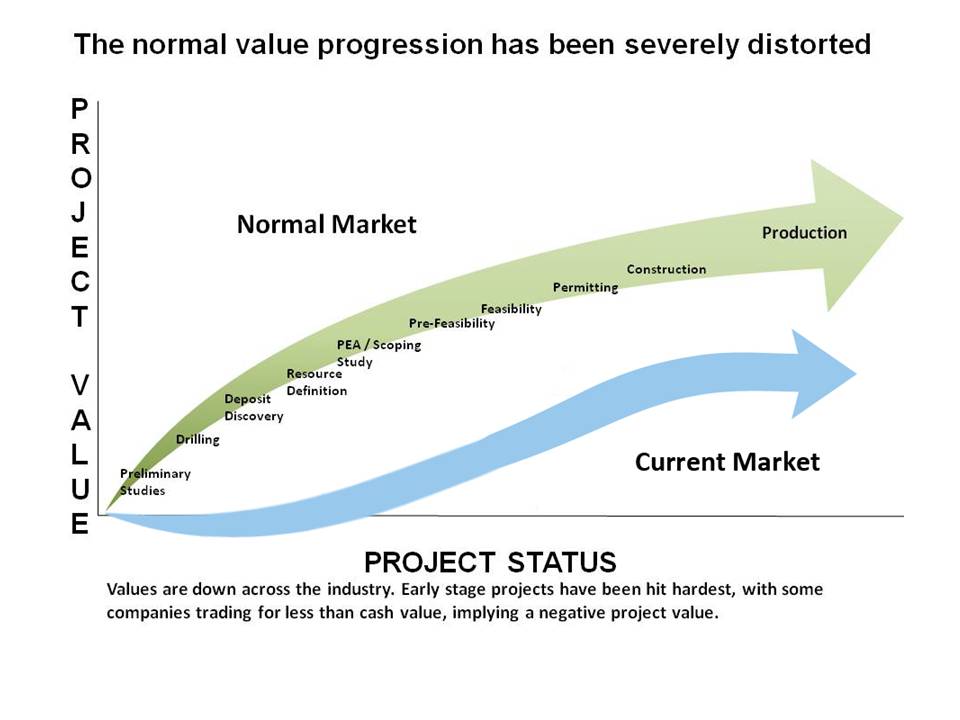

It is really important to understand the exploration and development cycle. There is a huge range, from companies hoping to make a discovery next week through to companies completing feasibility studies and about to begin development.

This curve shows the progression in value as resource companies advance a project from discovery toward production. In a normal market, a gold project with an inferred resource would be valued at about $10 per ounce of gold in the ground. By the time those ounces are placed into production, the valuation would be excess of $300 per ounce. In a normal market, there is potential for huge gains by advancing metal deposits through the exploration and development process toward production.

This is not a normal market!

This is what the lifecycle chart looks like in the present market. Share prices across the board have plummeted. But, the devastation has not been equal. Earlier stage projects have been hit far harder than the more advanced projects. In fact, there are companies with high quality early stage projects which are trading for less than cash value, implying a negative value for those early stage projects.

Eventually, that curve will move back toward normal valuations. In the meantime, there is still tremendous scope for companies to add value as they move their projects along the curve.

At this time, investors can get a double upside: One, from the market eventually returning to normal, but even more importantly, as companies move their projects along the curve they will add value.

The recent sharp drop in the gold price has rattled many investors. From a high of $1787 last October, the price is down 31%. That drop is in line with the sharp fall in the bullion price in 2008: from a high of $1011 in March, bullion tumbled 30% by October. Over the following three years, the gold price rose 250%.

Regardless of the short term gyrations in metal prices, there is clearly a need for new mines and it is getting harder to make new discoveries.

Africa will play an increasingly important role in the mining industry. It holds one of the richest treasure troves of metals on the planet. That treasure has been under-appreciated, in large part due to politics in various counties within Africa. The situation is improving, even if perceptions may take a while to catch up to reality. Those perceptions are critically important.

The challenge for many companies now is finding the money to advance their projects along the curve. Traditionally, exploration companies would raise equity in the public markets. At this time, the equity markets are extremely difficult. There is money available, but it is difficult to raise equity, especially for projects perceived to be risky or for early stage projects.

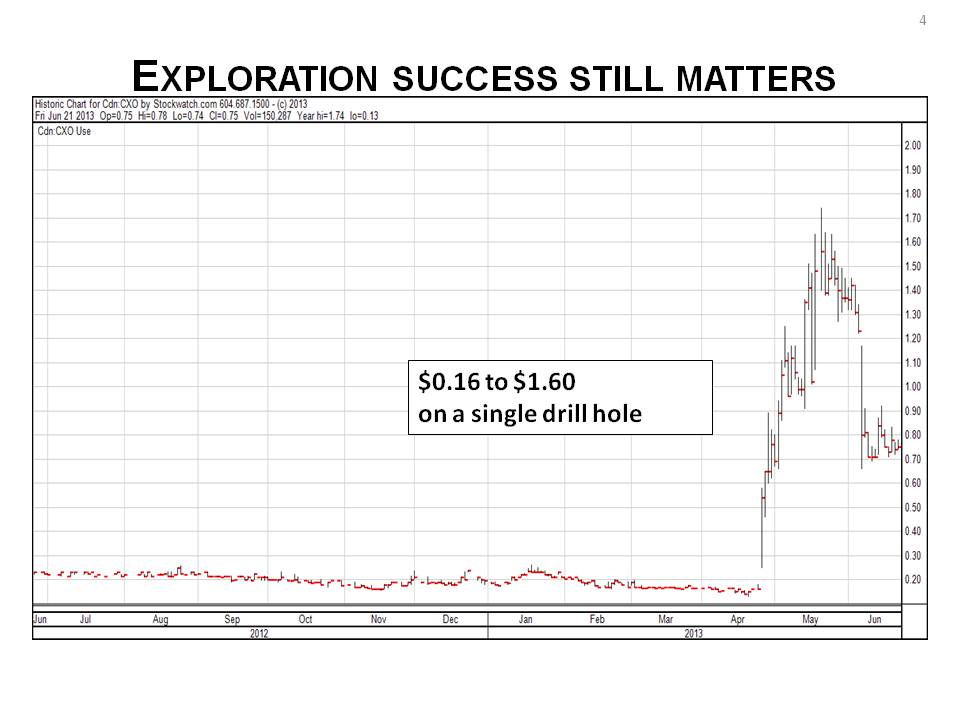

Having said that, there is still tremendous investor interest in new discoveries.

The previous chart shows a recent 10-fold gain in a junior’s share price on the basis of a single drill hole in a new target. As is often the case, the subsequent drill holes confirmed the importance of the discovery, but were slightly less exciting than the first hole.

In fact, there are billions of dollars sitting on the sidelines looking for the right projects. The challenge for many junior resource companies is that those investors still in the market are far more discerning than was the typical investor a couple of years ago.

Now, investment managers are evaluating projects much more closely than ever before. They are also very interested in who is managing the project. Only the top management groups are able to instill enough confidence to be able to raise money.

The traditional large Western mining companies have pledged to the shareholders that they will go slow on growth. That has put a huge damper on the junior resource sector. It is important to realize that there are literally hundreds of other mining companies and other groups interested in the mining industry which are capable of making multi-hundred million dollar acquisitions.

The metal processing companies are actively seeking out opportunities to link investments with offtake agreements. There are state owned enterprises and sovereign wealth funds which are also seeking greater involvement in the mining industry. Another huge pool of capital is also getting active in the mining sector; that is private equity.

Royalty and streaming deals have become far more important than they were in the past. There is a great deal of money available in the various royalty and streaming companies, but for the most part, money is available only for development stage projects.

Nearly all of the players still in the business are focused mainly on advanced stage projects.

As I noted a moment ago, investors are much more risk-averse than they were in the past. Speaking from a North American perspective, Africa is seen as generally more risky than many other places. The problem is that many investors take a superficial view, seeing the entire continent as one place.

The Arab spring and the apparent spread of the turmoil to the south rattled a lot of investors. Last year’s situation in Mali and the ongoing strife in several countries dominate the North American perspective of Africa. The perception of wide-spread corruption is also very damaging.

In reality, large parts of Africa are far more attractive for investors than many other parts of the world. For example, Kinross just wrote of their investment in Ecuador after investing a billion dollars in what should have been an attractive gold deposit.

The problem for the mining industry is that civil strife, and ethnic violence and other forms of bloodshed attract a great deal more media attention than does news of the royalty rate in Ecuador or such places. In reality, the royalty situation will destroy more wealth than will violence in a far-off part of a very large continent. Unfortunately, the perceptions tend to overwhelm reality, at least in the short term.

The net result is that the share prices of junior resource companies in many cases are trading at irrationally low values. Companies with interests in Africa, with the perception of greater risk, are trading at even lower values. Those low values represent outstanding investment opportunities.

Every day, people ask me: When will the market turn? Most people don’t like my answer, which is: It may be a long time yet before the overall market for juniors turns. You see, we are still carrying the baggage of all those losing lottery tickets. As shares of those companies continue to decline to their fundamental value, it gives the sense that the whole market is still in free fall.

In the meantime, there is growing support for the high quality companies. The sophisticated investors are always the first into the markets, getting positions before the crowds.

Companies with good projects and good management will double or better before someone rings a bell to say that the market has hit bottom and is about to turn up.

Resource Opportunities has been providing subscribers with successful stock picks in the 100%subscriber-supported newsletter for over a decade. No company ever pays to receive coverage, and they are included in the newsletter based solely on the merits of the company. My decades of experience in this sector have helped me identify which companies have the best outlook for success, and this research is what I present to subscribers. As a geologist and business analyst, I do conduct an extraordinary level of due diligence, which includes site trips all over the world to obtain a first-hand look at the projects, and am often ahead of the pack when it comes to making company recommendations. In the past year alone we have seen tremendous gains in companies like Colorado Resources, Sandstorm Gold and SantaCruz Silver, many of which we were the first to cover. The Resource Opportunities newsletter has recommended over 25 Ten Baggers to subscribers, many of which were recommended in a market JUST LIKE THIS ONE. Now is the time for smart investors to lay the foundations for future wealth.

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:  Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter:

Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter: