by James Kwantes

Resource Opportunities

North Arrow Minerals is one of three Resource Opportunities sponsors.

The November 1991 discovery of diamonds in the Northwest Territories by Chuck Fipke and Stu Blusson put Canada on the global diamond map. It also triggered one of the largest staking rushes in the world, as hundreds of companies hurried north to find treasure.

A few years later, many had retreated to warmer climes. One company that remained in the hunt was Gren Thomas’s Aber Resources, with a large land package staked by Thomas and partners at Lac de Gras near the Fipke find. In the spring of 1994, an Aber exploration crew led by Thomas’s geologist daughter, Eira Thomas, raced the spring melt to drill through the ice in search of kimberlite — the rock that sometimes hosts valuable diamonds.

It was a longshot. Since the Fipke find, the great Canadian diamond hunt had virtually ground to a halt — despite the millions of dollars spent in search of the glittery stones. But the drill core from that final spring hole had a two-carat diamond embedded in it. The Diavik discovery meant it was game on for Aber — and Canada’s nascent diamond industry.

DIAMOND POWER PLAYER

A quarter century after that fateful hole was punched through melting ice, Canada punches above its weight in the world of diamonds. Measured by value, the country is the third largest producer of diamonds by value globally. And the valuable diamonds that continue to be unearthed at the Diavik mine discovered by Aber are a big reason why.

The discovery unleashed a wave of shareholder value. The shares of Aber and its successor companies went from pennies to more than $50 as the quality of the diamonds and the asset became known. Dominion Diamond Corp., as Aber is now known and which owns the Ekati mine and 40% of Diavik, is Canada’s premiere diamond company. Diavik is expected to produce about 7.4 million carats this year, making it among the world’s largest diamond operations.

The team behind the Diavik discovery has also created a fair amount of shareholder value in the years since, led by Eira Thomas. She has co-founded two diamond players, Stornoway Diamond Corp. and Lucara Diamond Corp., and remains a director of the latter Lundin Group company. Her most recent gig, as CEO of Kaminak Gold, ended rather well — Goldcorp bought the company for $520 million last year.

Thomas is also an advisor to North Arrow Minerals (NAR-V), a cashed-up junior company at the forefront of Canadian diamond exploration. Aber’s Gren Thomas is North Arrow’s chairman and the CEO is Ken Armstrong, a former Aber and Rio Tinto geologist. North Arrow recently raised $5 million to explore its portfolio of projects and a drill program is underway at its advanced-stage Naujaat project, which hosts a population of valuable fancy orangey yellow diamonds.

In a space with few new discoveries or development projects, Canada is home to two of the world’s new diamond mines. Stornoway’s Renard mine in Quebec and Gahcho Kue, a De Beers-Mountain Province joint venture in the Northwest Territories, have both recently begun commercial production.

Globally, the diamond industry has faced headwinds, including India’s demonetization and choppy rough stone prices. But diamonds remain a money maker for some of the world’s largest mining companies, including Rio Tinto (60% owner of Diavik) and Anglo American. Incoming Rio boss Jean-Sebastien Jacques identified diamonds as a “priority area” last year in a Bloomberg interview: “I would love to have more diamonds, to be very explicit.” The company recently backed up those words by signing a three-year, $18.5-million option on Shore Gold’s Star-Orion South diamond project in northern Saskatchewan.

And Anglo’s De Beers division remains a reliable profit generator. In 2016, rough diamond sales surged for both Anglo American (up 36%) and Russian producer Alrosa (up 26%), according to The Diamond Loupe. A recent hostile takeover bid for Dominion Diamond reflects the demand for well-run diamond mines, which are powerful profit machines.

EXPLORATION DEFICIT

The picture is less promising on the exploration front. Budgets dried up during the mining slump that began in 2011, and little grassroots exploration work is being done. It’s particularly problematic for supply because diamond mines take longer to discover, evaluate and build pharm. The new Canadian mines will help fill the gap, but it won’t be enough. Economic diamond discoveries have simply not kept pace with mine depletion, globally.

“There are definitely a lack of new projects, at least new projects that are close to infrastructure,” said Paul Zimnisky, a New York-based independent diamond analyst. “There really is not much at all in the global diamond production pipeline.”

Economic, world-class diamond projects are few and far between, and most exploration companies looking for them have failed, Zimnisky explained. That has resulted in wariness and declining interest among investors: “In general, shareholders have not done well in diamonds.”

The looming supply deficit is particularly acute for rare coloured diamonds, which fetch higher prices. Australia’s Ellendale mine produced an estimated 50% of the world’s fancy yellow diamonds before closing in 2015. The Argyle mine, also in Australia, is one of the world’s biggest mines and a source of valuable coloured diamonds, including extremely rare pinks. It, too, is slated to close in the coming years, after decades of production.

North Arrow’s Naujaat could help fill the void. The project hosts a population of fancy orangey yellow diamonds that are more valuable because of their rarity. Naujaat is on tidewater, which dramatically reduces costs, and hosts a very large diamondiferous kimberlite, Q1-4, that outcrops on surface.

It’s the focus of this year’s $3.2-million program, which will see North Arrow drill 4,500 metres and collect a 200-tonne mini bulk sample. The goal is to extend the Inferred resource to a depth of at least 300 kilometres below surface and better define the diamond population. The sample will be shipped south in late August and processed in the fall.

“There is excellent potential to extend the Q1-4 kimberlite at depth, beyond the reach of past drilling efforts,” said North Arrow CEO Ken Armstrong. “It’s the first drilling in more than 12 years. The work will help us confirm and update the size of Q1-4 and improve our understanding of the deposit’s internal geology and diamond distribution.”

In 2014 and 2015, North Arrow collected a small bulk sample at Naujaat (formerly known as Qilalugaq) with the goal of gauging diamond values. But the carat values on the small 384-carat package came in significantly below expectations. North Arrow shares were relegated to the market penalty box and the company has been largely under the radar since, despite important background work that set the stage for this year’s program.

RISK AND OPPORTUNITY

Contrarian investing and the ability to time cycles can lead to fortunes in the junior mining sector. Vancouver investor Ross Beaty has proven it, time and again. In the early 2000s, with copper trading for under US$1 a pound, his team assembled a portfolio of unwanted copper assets in a bear market. He developed and sold those projects during bull markets, turning $170 million in invested capital into shareholder returns of $1.87 billion. His latest win was a large bear-market investment in Kaminak Gold, later bought out by Goldcorp.

Beaty’s latest contrarian bet is on North Arrow, through a $2-million investment that was part of the recent $5-million private placement financing. Other investors included the New York-based Electrum Strategic Opportunities Fund ($2 million) and company management and directors. The money will fund an aggressive program at Naujaat including drilling and a bulk sample, as well as exploration at North Arrow’s Mel, Loki and Pikoo projects.

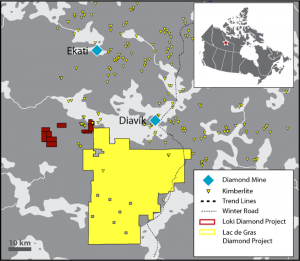

North Arrow also has exposure to drilling through the LDG (Lac de Gras) joint venture with Dominion Diamond Corp. That project borders on the mineral leases where Diavik is located. Ekati is 40 kilometres to the northwest. Dominion plans to drill several targets later this summer as part of a $2.8-million exploration program. North Arrow will have a 30% interest in the JV.

With a target on its back, Dominion is highly motivated to enhance shareholder value. And that extends beyond mine operations to exploration and new discoveries. In May, Dominion announced a “renewed strategic focus on exploration” and a $50-million, five-year exploration budget.

A FANCY EDGE

As for Naujaat, North Arrow is revisiting the project after a polishing exercise yielded fancy yellow diamonds that turned some heads in the industry. Several were certified “fancy vivid” diamonds, a coveted designation in the coloured diamond world. The quality of the polished stones suggests the fancy orangey yellow diamonds at Naujaat are considerably more valuable than the June 2015 valuation of the roughs indicated.

The primary conclusion of the diamond evaluators was that the 384-carat parcel of Naujaat diamonds was too small to properly evaluate. North Arrow plans to remedy that, in part, by collecting a 200-tonne bulk sample that should yield another 80 to 100 carats. The sample will be taken from the kimberlite’s highest-grade zone, A61. Lab results are expected in early 2018.

Another complicating factor at Naujaat is the presence of two distinct diamond populations of different ages, including a population of rare fancy yellow diamonds. It’s a consideration that was not factored into the prior carat valuation. It will be next time. Diamonds are a rarity play, and diamonds that occur less frequently — such as coloured diamonds and large diamonds — are more valuable. Yellow diamonds made up only 9% of the 2015 Naujaat sample by stone count, but more than 21% by carat weight.

The drilling at Naujaat is targeting kimberlite between 200 and 300 metres in order to bring material designated target for future exploration (TFFE) into the Inferred category. That drilling, plus the mini bulk sample, should help North Arrow better evaluate the diamond deposit on the path to a future Preliminary Economic Assessment. The Q1-4 kimberlite has a horseshoe shape that makes it amenable to open-pit mining and a low strip ratio. A larger bulk sample is planned for 2018.

COLOURED CARATS

Fancy yellow diamonds were thrust into the spotlight earlier this month when Dominion unveiled the striking 30.54-carat Arctic Sun, a fancy vivid yellow diamond cut from a 65.93-carat stone unearthed at Ekati. Dominion also played up coloured diamonds in their latest corporate presentation — specifically, the sweetener effect of high-value fancy yellow and orange diamonds at Misery.

The potential emergence of Canadian coloured diamonds could help solidify Canada’s position on the world diamond stage, according to analyst Zimnisky. On the branding and marketing side, Canadian diamonds continue to have strong appeal because of their high quality and ethical sourcing.

And the two recent Canadian mine openings are a bright spot for the global industry, despite early growing pains at both Gahcho Kue (lower-than-expected values) and Renard (breakage), he pointed out.

“There is absolutely an opportunity to sell Canadian diamonds at a premium, especially in North America,” Zimnisky said. The United States remains the world’s largest diamond market, despite the growth in demand from China and India.

Important hurdles remain before any mine is built at Naujaat, but the strength of North Arrow’s management team bodes well for success, according to Zimnisky.

“North Arrow is looking for something world-class and it’s high-risk, high-reward,” said Zimnisky, who has seen the company’s cut and polished fancy yellow diamonds: “They’re beautiful.”

The appetite for fancy yellow and other coloured diamonds remains strong, despite the closure or pending closure of two of the mines that produce many of them. Last year a De Beers store opened on Madison Avenue in New York, Zimnisky said, and the feature diamond on opening day was a very large fancy yellow of more than 100 carats.

DISCOVERY POTENTIAL

Further north of Naujaat on Nunavut’s Melville Peninsula is another North Arrow project with a good shot at a kimberlite discovery. At the Mel property, 210 kilometres north of Naujaat, North Arrow geologists have narrowed down and defined three kimberlite indicator mineral (KIM) trains through systematic soil sampling over several seasons. Last year’s till sampling defined where the KIM train is cut off, suggesting the bedrock kimberlite source is nearby.

The discovery of a new kimberlite field this season is possible, since kimberlites in the region outcrop at surface. “It’s a first look, but there’s potential for discovery without drilling,” says CEO Ken Armstrong.

As for the Lac de Gras joint venture, the US$1.1-billion hostile takeover bid for Dominion unveiled by the private Washington Corp. earlier this year may work in North Arrow’s favour. In addition to spurring a stock surge, the bid forced the diamond miner to crystallize its focus on creating shareholder value. And a key strategy for Dominion, with its two aging mines, is a renewed exploration push.

Finding new diamondiferous kimberlites in proximity to its existing operations would be a big boost for Dominion. One of its best shots is through the joint venture with North Arrow, which covers 147,200 hectares south of Ekati and Diavik. Dominion is spending $2.8 million on the project this season, including a planned drill program in the fall. North Arrow is well-positioned to capture the value of any Dominion kimberlite discoveries made.

North Arrow also plans to drill two or three promising kimberlite targets at its nearby 100% owned Loki project, dovetailing with the completion of the LDG drilling. The company has received a $170,000 grant from the Northwest Territories government to drill Loki. North Arrow will also conduct till sampling in the fall at Pikoo, its Saskatchewan diamond discovery, in advance of a potential early 2018 drill program.

Disclosure: Author owns shares of North Arrow Minerals. North Arrow is one of three company sponsors of Resource Opportunities, helping keep subscription prices low for the subscriber-supported newsletter. North Arrow Minerals is a high-risk junior exploration company. This article is for informational purposes only and all investors need to do their own research and due diligence.

Subscribe to Resource Opportunities until July 15 and use COUPON CODE JUNE to receive US$100 off regular subscription prices of $299 for 1 year and $449 for 2 years. Our focus is actionable investment ideas with high speculative upside potential. Recent examples: $ERD.T at 37.5c & $SBB.T at 39c. Join today and profit!

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:  Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter:

Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter: