by James Kwantes

Resource Opportunities

Genesis Metals is one of three Resource Opportunities sponsor companies.

Genesis Metals is building ounces and grade at its Chevrier project in Quebec’s Abitibi Greenstone Belt, as Phase 1 drill results outline growing zones of higher-grade material within the existing Main Zone deposit. The drill results are changing the profile of the deposit, which hosts current indicated mineral resources of 395,000 ounces (8.5 Mt averaging 1.45 g/t gold; cutoffs 0.5 g/t open pit and 0.95 g/t underground) and inferred mineral resources of 254,000 ounces (5.9 Mt averaging 1.33 g/t gold; cutoffs 0.5 g/t open pit and 0.95 g/t underground).

The latest drill intercepts are well above those average grades, with highlights including:

GM20-63: 9.71 g/t Au over 3.65 metres (within 76 metres of 1.93 g/t)

GM20-64: 9.73 g/t Au over 4.5 metres (within 84 metres of 1.65 g/t)

GM20-64: 9.64 g/t Au over 2.3 metres

GM20-64: 14.4 g/t Au over 2.2 metres

GM20-65: 5.57 g/t Au over 3.2 metres

Those intercepts were part of the second and final batch of assays from the 2,500-metre drill program at Chevrier that focused on southwest and northeast portions of the Main Zone. Most of the current resource estimate is contained within the Main Zone, with the East Zone hosting a small Inferred resource. Genesis used a new 3D model to better understand distribution and controls on high-grade gold mineralization.

Genesis CEO David Terry and his team are now reviewing the drill hole data as they evaluate the best targets for follow-up drilling, which is fully funded. The next drill program will likely take place in late summer or early fall; a further 5,500 metres of drilling is planned for the remainder of 2020.

Each of the Phase 2 intercepts above starts within 200 metres of surface, and holes 63 and 64 hit high-grade within wider mineralized envelopes. That bodes well for future inclusion in the pit-constrained resource once Genesis updates the Chevrier resource estimate. Hole 65 also hit deeper gold mineralization: 5.14 g/t Au over 3.95 metres from 213.3 metres downhole, and 7.88 g/t Au over 3.1 metres from 227.5 metres downhole.

Those assays followed Phase 1 drill results from Chevrier announced on June 2 that included:

8.92 g/t Au over 1.0 metres (within 1.79 g/t over 7.35 metres)

3.99 g/t Au over 3.0 metres

10.2 g/t Au over 1.15 metres (within 1.36 g/t over 19.7 metres)

“We look forward to additional drilling to better define this new high-grade component of the deposit, and to results from the ongoing surface exploration program focused on advancing priority targets elsewhere on the large Chevrier project,” Terry stated.

Likely targets include further definition of higher-grade shoots within and below the existing Main Zone deposit, as well as several high-priority targets elsewhere at Chevrier identified through last year’s property-wide glacial till survey. Ground prospecting to further refine those targets continues.

The biggest beneficiaries in this emerging gold bull market are juniors that can hit meaningful drill results containing high-grade gold. The Phase 1 drill program has delivered that for Genesis, with several hits that are multiples of average grades at the existing deposit. The company’s $15-million valuation — less than many pre-drill juniors — is backstopped by Chevrier’s existing gold resource and now, growing higher-grade zones.

The widths and grades of Genesis’s Phase 1 drill program compare favourably to the mineralization at well-known Canadian gold deposits including SSR Mining’s Seabee underground gold mining operation in northern Saskatchewan. Seabee’s average reserve grades are just above 10 g/t gold and the company is underground mining widths of 1-2 metres.

Genesis, of course, is an earlier-stage play. But the company’s shares remain under the radar, with the stock trading at or below where it spent most of 2019. That’s despite the developing high-grade zones as well as these positive features:

- Backing of the serially successful Discovery Group;

Located on a highway and near rail lines in the eastern Abitibi greenstone belt in a thriving mining district (Chibougamau) with other high-grade discoveries;

More than $2 million in the treasury for further drilling later this year.

Fresh approach under the leadership of Dr. David Terry and property-wide investigation and analysis, starting with soils.

Chibougamau is a rich gold mining district of high-grade discoveries and historical mines. More than 6.7 million ounces of gold has been mined in the area and there are plenty more ounces in the ground — including at high grades. Just southwest of Chevrier is the Monster Lake JV, where IAMGOLD and JV partner TomaGold have delineated 433,300 ounces of gold at 12.14 g/t Au.

Team, backers, project and neighbourhood — it all matters. So does price of entry. There’s a lot of money chasing a small number of hot junior stocks that have been running hard. But the big money is made positioning in promising plays that have yet to move. Genesis’s current valuation may spell opportunity for investors confident that this top team will identify more high-grade gold, both within the existing deposit and through discoveries elsewhere on the 290-sq-km property.

Disclosure: Genesis Metals is one of three Resource Opportunities sponsor companies and James Kwantes owns Genesis Metals shares, which makes him biased. This article is presented for information purposes and is not investment advice. All investors need to do their own due diligence.

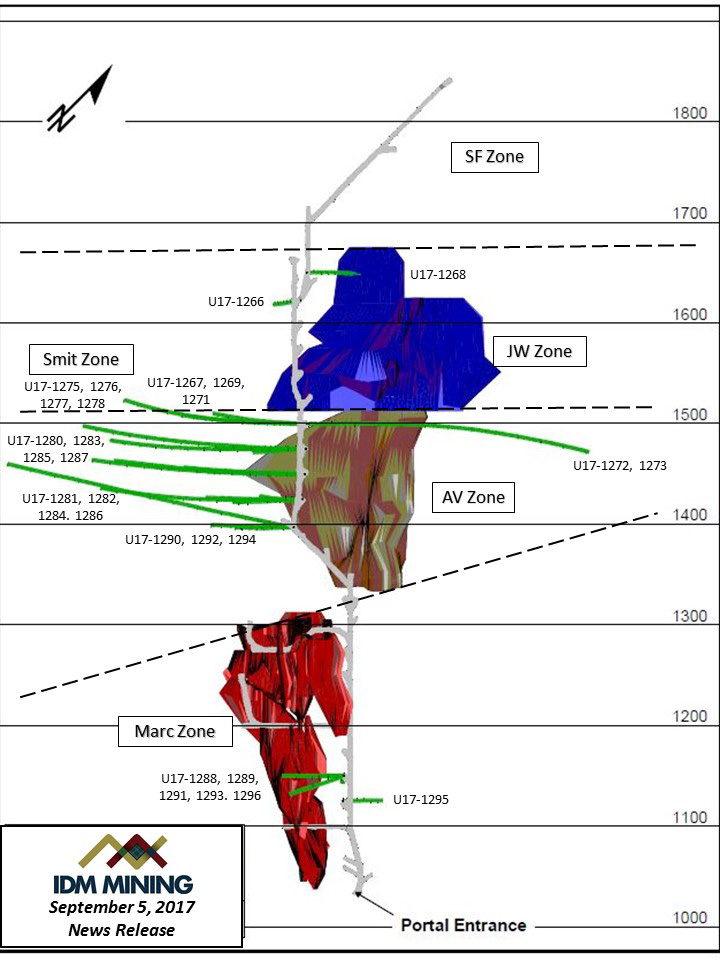

Underground drilling

Underground drilling IDM Mining CEO Rob McLeod points toward the mill/tailings facility location in the Bitter Creek Valley.

IDM Mining CEO Rob McLeod points toward the mill/tailings facility location in the Bitter Creek Valley.

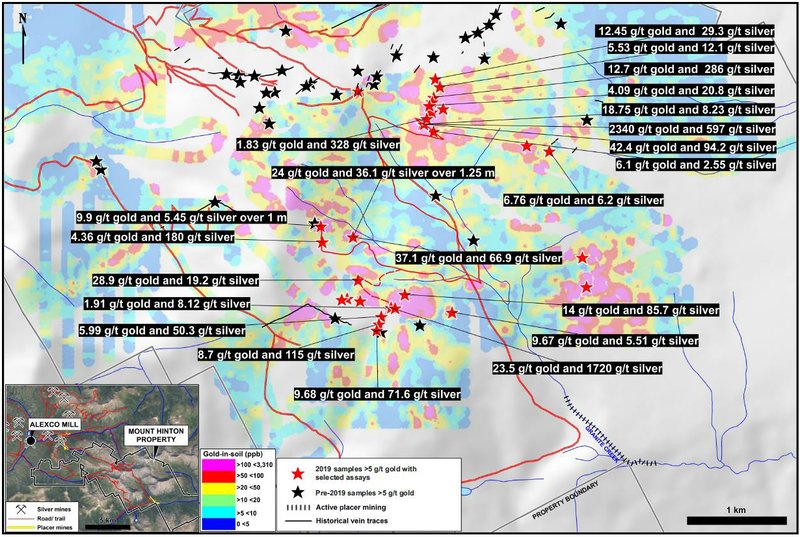

Lost Valley gold mineralization

Lost Valley gold mineralization James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Mr. Kwantes has two decades of journalism experience and was the mining reporter at the Vancouver Sun. Twitter:  Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter:

Resource Opportunities (R.O.) is an investment newsletter founded by geologist Lawrence Roulston in 1998. The publication focuses on identifying early stage mining and energy companies with the potential for outsized returns, and the R.O. team has identified over 30 companies that went on to increase in value by at least 500%. Professional investors, corporate managers, brokers and retail investors subscribe to R.O. and receive a minimum of 20 issues per year. Twitter: